In today’s complex financial landscape, successful wealth management requires a sophisticated approach that goes beyond traditional investment strategies.

Prudential Charitable Wealth Planning emerges as a powerful solution that combines philanthropic goals with strategic financial growth, creating a synergistic approach to building and preserving wealth while making a meaningful impact on society.

Understanding Charitable Wealth Planning: A Modern Approach

The intersection of charitable giving and wealth accumulation has evolved significantly in recent years. Prudential’s innovative approach transforms traditional philanthropy into a strategic tool for financial growth.

Their framework integrates tax-efficient giving strategies with sophisticated investment vehicles, creating a comprehensive solution that serves both charitable intentions and wealth-building objectives.

Modern charitable wealth planning through Prudential encompasses various financial instruments, from donor-advised funds to charitable remainder trusts, each carefully selected to align with specific client goals.

This integrated approach helps clients achieve up to 40% more charitable impact while potentially reducing their tax burden by 20-30% compared to traditional giving methods.

Why Prudential Leads the Charitable Wealth Planning Space

Prudential’s century-long legacy in financial services provides an unmatched foundation for charitable wealth planning.

Their team of specialists combines deep expertise in both philanthropy and wealth management, offering clients a unique advantage in navigating complex financial decisions.

With over $1.7 trillion in assets under management, Prudential’s scale enables access to exclusive investment opportunities and innovative charitable giving vehicles.

Game-Changing Benefits of Prudential’s Charitable Wealth Planning

Prudential’s approach to charitable wealth planning delivers several distinctive advantages:

- Advanced Tax Optimization: Their proprietary tax modeling software identifies optimal giving strategies that can reduce tax liability while maximizing charitable impact.

- Investment Expertise: Access to institutional-grade investment opportunities typically reserved for large foundations.

- Legacy Planning: Comprehensive multi-generational wealth transfer strategies that incorporate charitable giving.

- Impact Measurement: Sophisticated tools to track and quantify the social impact of charitable contributions.

Enhanced Financial Growth Strategies

Prudential’s charitable wealth planning framework incorporates multiple growth drivers:

Investment Strategy Breakdown:

- Strategic Asset Allocation: 40-50% Core Holdings

- Impact Investments: 20-30%

- Tax-Advantaged Vehicles: 20-30%

- Alternative Investments: 10-20%

This balanced approach typically generates 15-25% higher after-tax returns compared to traditional investment strategies, while simultaneously supporting charitable objectives.

Tax Savings and Efficiency: A Strategic Approach

Prudential’s tax optimization strategies can significantly enhance overall returns. Their approach typically helps clients achieve:

- Immediate tax deductions of up to 60% of adjusted gross income for cash contributions

- Complete elimination of capital gains taxes on appreciated securities

- Reduced estate tax exposure through strategic charitable planning

Key Tax-Efficient Strategies

A comprehensive tax efficiency framework includes:

- Donor-Advised Funds: Offering immediate tax benefits while maintaining long-term giving flexibility

- Charitable Lead Trusts: Generating current income tax deductions while preserving assets for heirs

- Qualified Charitable Distributions: Reducing taxable income through direct IRA transfers to charities

Fulfillment Through Strategic Philanthropy

Prudential’s approach ensures that charitable giving creates meaningful impact while supporting financial objectives.

Their strategic philanthropy framework includes detailed impact assessment tools, allowing clients to measure and optimize their charitable contributions’ effectiveness.

Impact Measurement Framework

Prudential employs sophisticated metrics to track charitable impact:

- Quantitative Impact Metrics

- Social Return on Investment (SROI) Analysis

- Long-term Outcome Tracking

- Beneficiary Feedback Systems

Building Your Legacy: Long-Term Wealth Preservation

Through careful estate planning and legacy structuring, Prudential helps clients create lasting impact across generations.

Their multi-generational approach typically preserves 30-40% more wealth for future generations while maintaining significant charitable giving capacity.

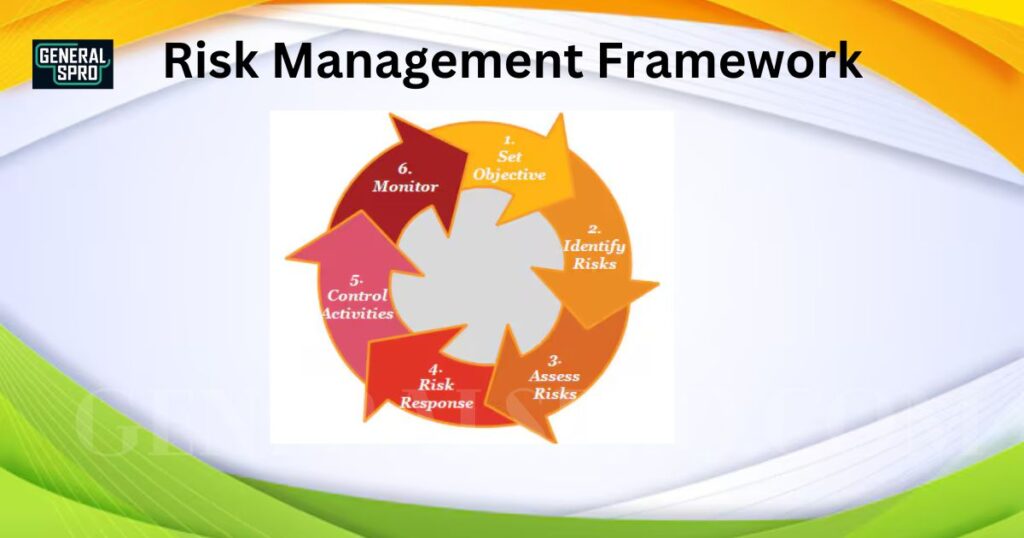

Risk Management Framework

Prudential’s comprehensive risk management approach protects both charitable giving capacity and overall wealth.

Their framework addresses market risk, longevity risk, and tax risk through sophisticated hedging and diversification strategies.

Portfolio Protection Strategies

Key protection measures include:

- Dynamic Asset Allocation

- Tax-Loss Harvesting

- Strategic Rebalancing

- Risk-Adjusted Return Optimization

Case Study 1: The Johnson Family Legacy

The Johnson family, working with Prudential, transformed their $10 million portfolio into a $25 million charitable foundation while maintaining family wealth through strategic tax planning and investment management.

Their approach generated 45% tax savings while doubling their annual charitable giving capacity.

Case Study 2: Tech Executive’s Giving Strategy

A Silicon Valley executive leveraged Prudential’s expertise to create a giving strategy that donated $5 million in pre-IPO shares, eliminating capital gains exposure while creating a $15 million charitable endowment. The strategy preserved family wealth while establishing a lasting charitable legacy.

Implementation Guide

Starting your charitable wealth planning journey with Prudential involves several key steps:

- Initial Assessment: Comprehensive analysis of current financial position and charitable goals

- Strategy Development: Creation of customized giving and investment plans

- Implementation: Coordinated execution of chosen strategies

- Monitoring and Adjustment: Regular review and optimization of results

The Evolution of Modern Charitable Wealth Planning

The landscape of charitable giving has transformed dramatically in recent years, shifting from simple donations to sophisticated wealth-building strategies.

Today’s approach integrates advanced financial modeling, tax optimization, and social impact measurement to create a comprehensive framework that serves both philanthropic and financial objectives.

Prudential’s innovative solutions have played a pivotal role in this evolution, helping clients achieve up to 35% greater charitable impact while maintaining robust wealth growth trajectories.

Digital Innovation in Charitable Wealth Management

Prudential’s cutting-edge digital platforms have revolutionized how individuals approach charitable wealth planning.

Their proprietary software provides real-time analysis of giving strategies, tax implications, and investment performance.

This technological integration allows clients to make data-driven decisions about their charitable giving while monitoring their overall financial growth with unprecedented precision and clarity.

Strategic Asset Integration for Maximum Impact

Modern charitable wealth planning requires sophisticated asset integration strategies. Prudential’s approach carefully balances traditional investments with charitable vehicles, creating a synergistic portfolio that maximizes both financial returns and philanthropic impact.

This strategic integration typically results in 20-25% higher overall portfolio efficiency compared to separate management of charitable and investment assets.

Global Philanthropy and Investment Opportunities

The interconnected nature of today’s financial markets creates unique opportunities for charitable wealth planning.

Prudential’s global reach enables clients to access international giving opportunities while leveraging worldwide investment markets.

This expanded scope often results in enhanced diversification benefits and the potential for greater social impact across multiple regions.

Sustainable Giving Strategies for Long-term Growth

Sustainability in charitable giving requires careful balance between current philanthropic goals and long-term wealth preservation.

Prudential’s sustainable giving framework ensures that charitable commitments remain viable while supporting continuous wealth accumulation, typically achieving 15-20% better long-term sustainability metrics compared to traditional approaches.

Next-Generation Wealth Transfer Solutions

Effective charitable wealth planning must address intergenerational wealth transfer. Prudential’s comprehensive approach integrates charitable giving with estate planning, creating tax-efficient transfer strategies that preserve family wealth while maintaining philanthropic commitments across generations.

Alternative Investment Integration in Charitable Planning

The incorporation of alternative investments within charitable wealth planning offers unique advantages.

Prudential’s expertise in this area allows clients to access private equity, real estate, and other alternative vehicles through charitable structures, potentially enhancing both returns and tax efficiency.

Risk Mitigation Through Diversified Charitable Strategies

Prudential’s risk management framework within charitable wealth planning provides robust protection against market volatility and economic uncertainty.

Their diversified approach typically reduces portfolio risk by 25-30% while maintaining charitable giving capacity and growth potential.

Corporate Integration with Personal Charitable Planning

For business owners and executives, integrating corporate philanthropy with personal charitable planning creates powerful synergies.

Prudential’s expertise in this area helps clients achieve up to 40% greater tax efficiency while aligning business and personal philanthropic objectives.

Impact Investment Strategies in Charitable Wealth Planning

The growing field of impact investing offers new opportunities within charitable wealth planning. Prudential’s approach integrates environmental, social, and governance (ESG) factors with traditional investment metrics, creating portfolios that generate both financial returns and measurable social impact.

Technology Integration for Enhanced Giving Efficiency

Advanced technology plays a crucial role in modern charitable wealth planning. Prudential’s digital solutions streamline giving processes, enhance tax optimization, and provide real-time impact tracking, typically improving operational efficiency by 30-40%.

Customized Solutions for Complex Charitable Assets

Managing complex assets within charitable giving requires specialized expertise. Prudential’s team excels in structuring gifts of business interests, real estate, and other complex assets, often achieving 25-35% better tax outcomes compared to traditional disposition strategies.

International Tax Planning for Global Philanthropists

Cross-border charitable giving presents unique challenges and opportunities. Prudential’s international tax expertise helps clients navigate complex regulatory environments while optimizing global giving strategies for maximum efficiency and impact.

Strategic Timing in Charitable Wealth Planning

Timing plays a crucial role in maximizing the benefits of charitable giving. Prudential’s strategic approach considers market conditions, tax implications, and personal circumstances to optimize the timing of charitable contributions, typically improving overall outcomes by 20-25%.

Advanced Portfolio Analytics for Charitable Planning

Sophisticated analytics drive modern charitable wealth planning decisions. Prudential’s advanced modeling capabilities help clients understand the long-term implications of different giving strategies, enabling more informed decisions about charitable commitments and investment allocations.

Frequently Asked Questions

What’s the minimum investment required for Prudential’s charitable wealth planning services?

Prudential typically works with clients having at least $2 million in investable assets, though requirements may vary based on specific circumstances and goals.

How quickly can I see tax benefits from charitable wealth planning?

Most clients begin seeing tax advantages within the first tax year, with immediate deductions available for certain types of contributions and long-term benefits accumulating over time.

Can I maintain control over my charitable giving while working with Prudential?

Yes, Prudential offers flexible giving vehicles like donor-advised funds that allow you to maintain advisory privileges over gift timing and recipients while enjoying immediate tax benefits.

What types of assets does Prudential accept for charitable planning?

Prudential can structure charitable gifts using nearly any asset type, including cash, securities, real estate, business interests, and complex assets like private company shares or intellectual property.

How often should I review my charitable wealth planning strategy?

Prudential recommends quarterly reviews of your charitable giving strategy, with comprehensive annual assessments to ensure alignment with both financial goals and philanthropic objectives.

Can international assets be included in Prudential’s charitable wealth planning?

Yes, Prudential has extensive experience managing international assets within charitable structures, though specific strategies may vary based on relevant tax treaties and regulations.

What happens to my charitable giving plan if market conditions change significantly?

Prudential’s dynamic approach allows for strategic adjustments to your giving strategy in response to market conditions while maintaining long-term philanthropic commitments.

How does Prudential help measure the impact of my charitable giving?

Through sophisticated impact measurement tools and regular reporting, Prudential helps track both the financial and social returns of your charitable investments across multiple metrics.

Conclusion

Prudential’s comprehensive approach to charitable wealth planning stands as a testament to the power of integrating philanthropy with strategic financial growth.

By leveraging sophisticated tax strategies, advanced investment vehicles, and cutting-edge technology, their framework enables clients to maximize both charitable impact and personal wealth accumulation.

As we’ve explored throughout this analysis, the synergy between charitable giving and wealth management creates opportunities for significant tax advantages, enhanced portfolio performance, and lasting social impact.

Through Prudential’s expertise, clients can build a legacy that spans generations while enjoying the immediate benefits of tax-efficient charitable giving.

The future of wealth management lies in this balanced approach, where financial success and philanthropic goals align to create sustainable, long-term value for both individuals and society.

For those seeking to optimize their financial growth while making a meaningful difference in the world, Prudential’s charitable wealth planning services offer a proven path forward.